Introduction of ISO 20022: A Major Step into the Future of Payment Transactions

The introduction of ISO 20022 improves international payment transactions through standardized data formats, greater transparency, and faster transactions. tts GmbH has successfully completed the transition—thanks to strategic planning, technical expertise, and strong partnerships.

tts GmbH is the holding company of the tts corporate group based in Heidelberg. Under its umbrella, nationally and internationally renowned companies specializing in digital transformation are united. They offer holistic solutions in the areas of Digital Adoption, Corporate Learning, and Digital HR. Their goal is to support companies in enabling their employees to succeed in a digital world.

Since the founding of the first tts company in 1998, the organization has continuously evolved and is now known for its expertise in implementing digital learning platforms and HR solutions. The company has established itself as one of the leading providers in this field and is particularly valued for its innovative and tailored services.

What is ISO 20022?

ISO 20022 is revolutionizing payment transactions through a standardized structure for exchanging financial data. This international standard promotes efficient communication between banks and companies, supports the automation of transactions, and facilitates cross-border payments. By meeting regulatory requirements and improving transparency and efficiency, ISO 20022 is a significant step toward modern and secure payment transactions.

Why is the transition so important?

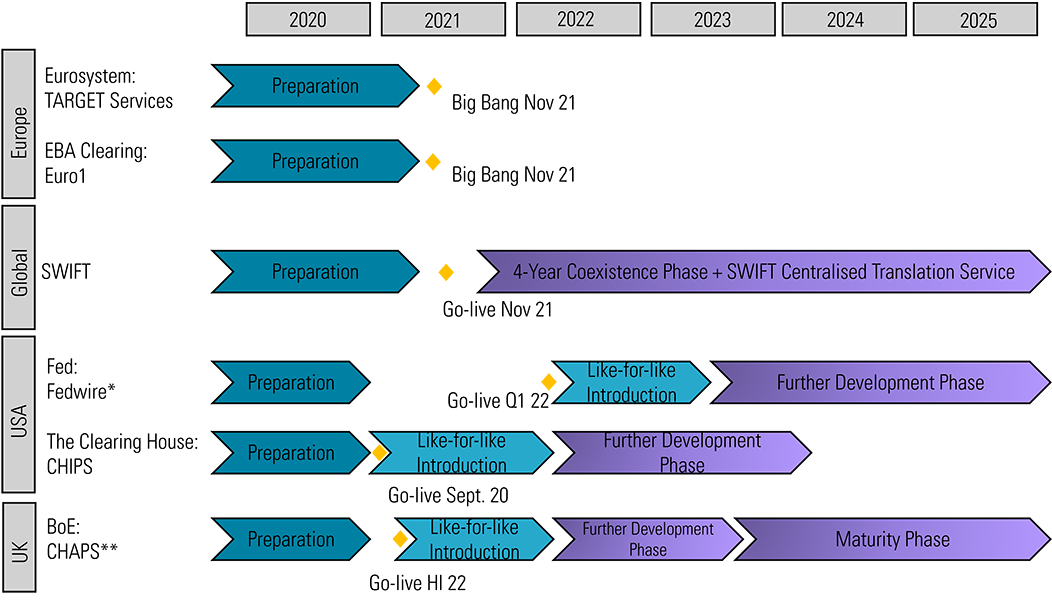

The ISO 20022 standard will be introduced worldwide for cross-border payments by November 2025. This new norm standardizes financial messages globally, increases transaction speed and security, and improves international payments.

For companies, the transition involves implementing software updates, adjusting interfaces, and updating customizations (and possibly master data) to meet the new requirements. Careful planning and timely implementation of these changes are crucial to ensuring the smooth flow of payment transactions and avoiding disruptions.