Electronic Invoicing:

SAP Solutions

Electronic invoicing, or e-invoicing, will be mandatory for companies in Germany starting in 2025. The biggest challenge is choosing the right software for implementation. SAP customers have various add-on solutions available, both SAP and non-SAP. XEPTUM helps you make the right decision.

The pressure is on: A recent study by the digital association Bitkom found that many companies still use unstructured digital formats like standard PDFs despite the increasing adoption of e-invoices. For these companies, the mandatory implementation of e-invoicing brings numerous requirements, even with a transition period until 2027 (until 2028 for companies with annual revenue under 800,000 euros). There is a lack of user-friendly solutions for getting started, making the selection of suitable software challenging.

What Does the Term E-Invoice Mean Exactly?

An e-invoice is an electronic invoice exchanged digitally between suppliers and customers. Unlike traditional paper invoices, e-invoices are created, transmitted, received, and processed electronically. They contain the same information as a paper invoice, including details about suppliers and customers, purchased products or services, invoice amounts, and payment terms.

What Are the Main Benefits of Mandatory E-Invoicing?

The benefits for federal, state, and local governments are clear: According to estimates by the European Commission and the Federal Ministry of Finance (BMF), the introduction of e-invoicing in Germany could gradually lead to additional tax revenues exceeding ten billion euros annually. Electronic invoice exchange also enables immediate VAT deduction control by tax authorities.

E-invoicing also offers numerous advantages for companies, such as:

- More Efficiency: Processing electronic invoices is generally faster and more efficient than manually handling paper invoices.

- Reduced Costs: Eliminating paper, printing costs, and manual processing can reduce expenses.

- Traceability: E-invoices can be easily tracked and archived in electronic systems.

- Environmental Friendliness: Using e-invoices helps reduce paper consumption and promotes environmental protection.

The biggest advantage of e-invoicing is that it often drives the digitalization of the entire company, serving as a catalyst for further digitalization processes and making long-term beneficial software more accessible, especially for smaller companies.

What Legal and Technical Requirements Must the E-Invoice Fulfill?

Starting in 2025, the Value Added Tax Act (§ 14 Abs. 1 UStG) differentiates between e-invoices and other invoice types. E-invoices must be created, transmitted, and received in a structured electronic format, enabling automated electronic processing. Invoices in Word or PDF format do not meet these requirements.

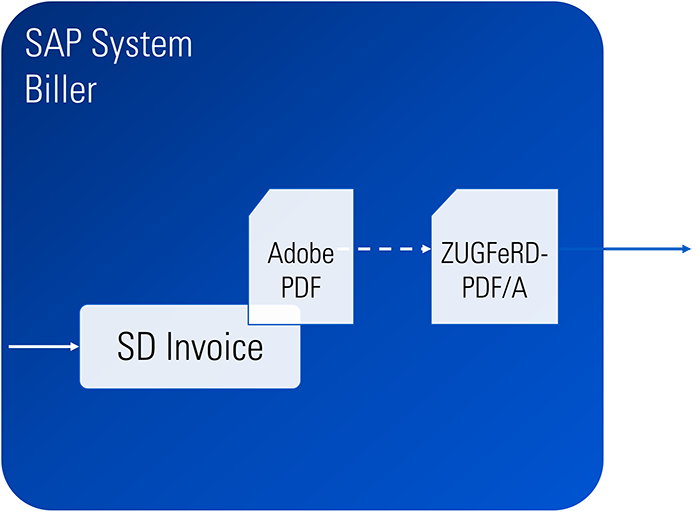

The structured electronic format must comply with European standards for electronic invoicing and the corresponding syntaxes. The tax authorities particularly consider invoices in the XStandard (known as XRechnung) and the ZUGFeRD format from version 2.0.1 (a combination of PDF document and XML file) as generally compliant with European e-invoice requirements. For hybrid invoice formats, the structured part should be prioritized in the future. Alternatively, the involved parties – the invoice issuer and recipient – can individually agree on the structured electronic format of the invoice. This also allows for invoices exchanged via EDI procedures. The open-ended technological approach also applies to future and potentially new invoice formats.

How Does SAP Support the Legal Requirements for E-Invoicing?

Companies face the challenge of implementing various laws for sending and receiving invoices in their IT systems. Invoice formats vary by country, and different transmission channels for e-invoices are required.

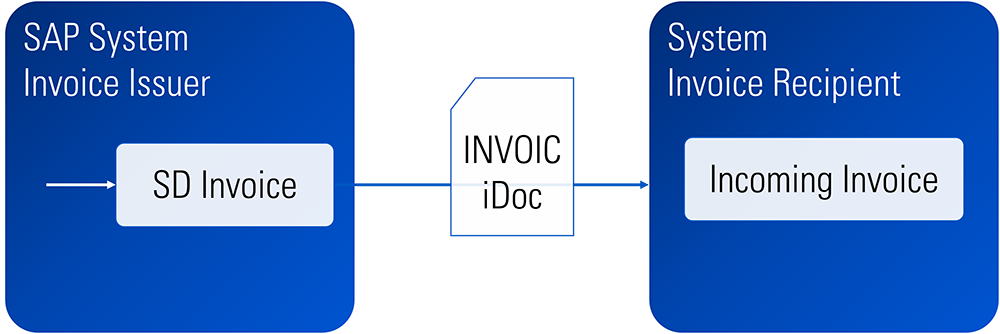

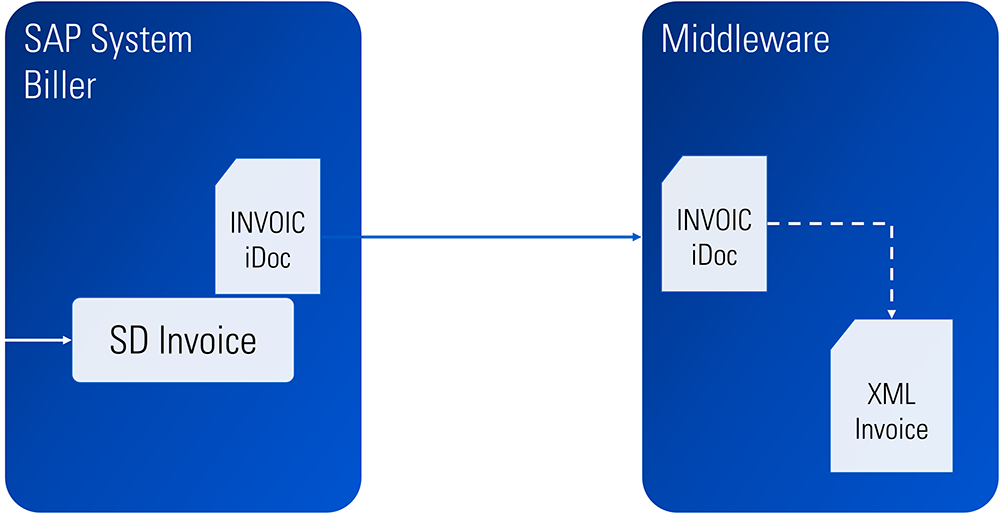

There are several options for integrating e-invoicing in SAP:

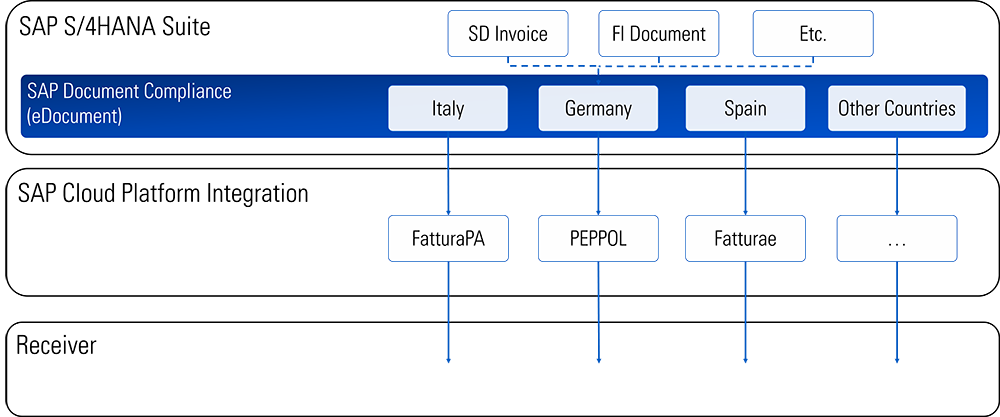

SAP Document Compliance (eDocument)

Companies using SAP as an ERP system can implement e-invoicing using the SAP eDocument Framework in conjunction with the SAP Application Interface Framework (AIF). The eDocument Framework converts documents from logistics, sales, and accounting into common e-invoice formats, such as XML files. However, it cannot send e-invoices via certain services like Peppol (Pan-European Public Procurement Online) for Germany or meet specific country requirements.

Therefore, the SAP Application Interface Framework (AIF) should be used to convert generated eDocuments into the required target format, such as XRechnung for Germany or InvoicePA for Italy. The e-invoices can then be sent via the SAP Cloud Platform using web services or through a service provider.