ISO 20022: Efficient Banking Communication and Cross-Border Payments

This new ISO standard is an international standard for the exchange of financial data, providing a uniform structure for messages related to payments, securities transactions, and other financial services.

What is ISO 20022?

ISO 20022 is an international messaging standard in the banking and financial industry that facilitates the exchange of structured and data-rich information between businesses and banks. This standard plays a crucial role in modernizing payment processes, offering multiple benefits. ISO 20022 messages use a unified language that is understood globally, supporting the automation of transaction processing and reducing manual interventions. The standard enables detailed information about payments as well as remittance data, which helps financial institutions offer new services and enhance analytical capabilities.

What is the significance of ISO 20022?

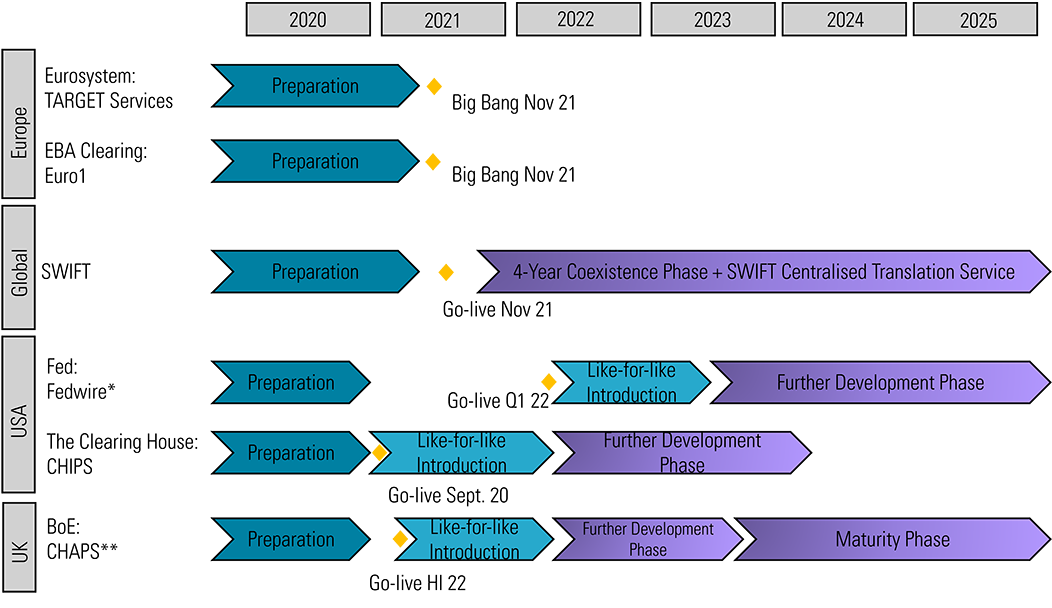

ISO 20022 is used in more than 70 countries and affects payments, securities, trade services, cards, and foreign exchange. Both the Fedwire Funds Service of the Federal Reserve and the Clearing House Interbank Payments System (CHIPS) are developing and planning the implementation of ISO 20022 in their systems. The transition period to ISO 20022 ends in November 2025, after which SWIFT MT messages will be discontinued.