SAP Financial Processes: AI for more Performance

Finance departments are the backbone of a company – and they are particularly affected by the shortage of skilled professionals. When employees for accounting and financial tasks are lacking, the entire business operation can suffer. With artificial intelligence (AI) and automation, these workforce gaps can be closed while optimizing SAP financial processes.

Finance departments oversee and manage all cash flows within a company, playing a crucial role in business success and growth. It is no surprise that the increasing shortage of skilled workers can have severe consequences in the financial sector – especially since many tasks are still performed manually, as highlighted by a recent PwC survey. To avoid this challenge, companies should consistently invest in the digitalization and automation of their operational financial processes.

What are the benefits of integrating AI-powered SAP interfaces into ERP?

The SAP ecosystem offers a range of innovative cloud solutions. A seamless integration of AI-powered SAP interfaces into the ERP system provides the ideal foundation for automating time-consuming and repetitive tasks across various financial domains. This approach not only compensates for the growing labor shortage but also enhances efficiency, transparency, and accuracy in financial processes. Companies can save time and costs while significantly reducing error rates, as demonstrated by the following SAP solutions.

How does SAP Cash Application improve bank statement processing?

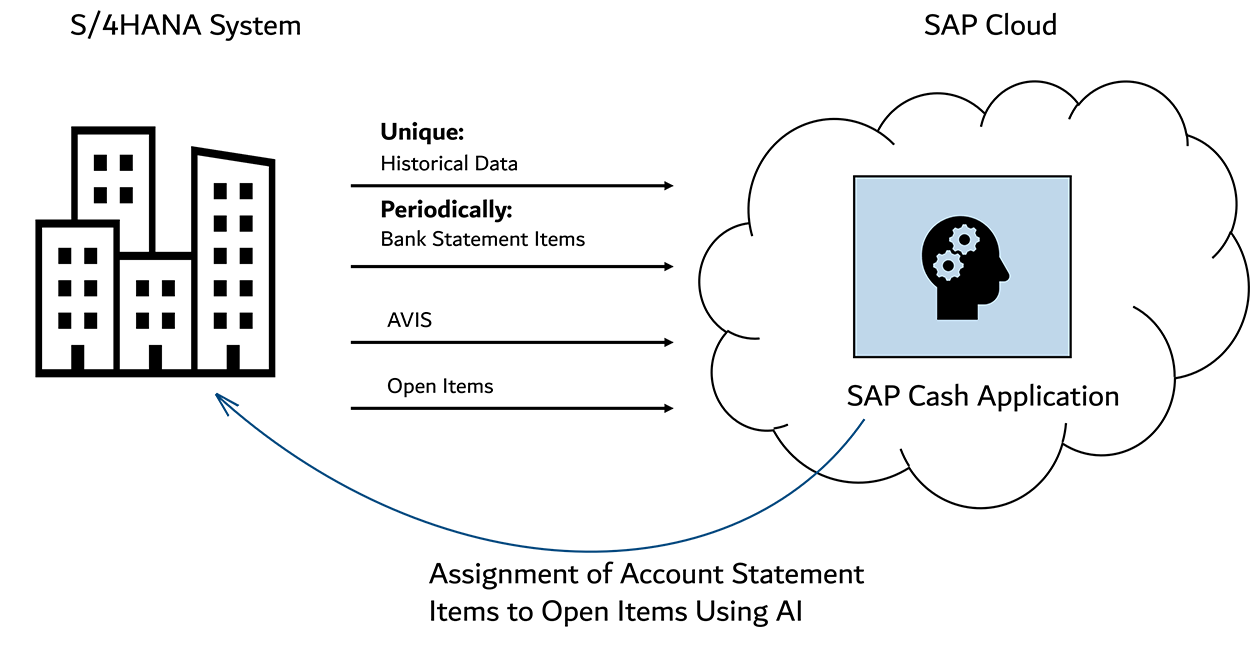

Manually assigning bank statement items to open invoices is a time-consuming and error-prone task. AI-powered bank statement processing addresses this challenge by leveraging machine learning (ML) to analyze historical decision patterns and convert them into a model that automatically and accurately processes future assignments.

With SAP Cash Application, a mature cloud solution is available to support this automation, significantly increasing the efficiency and accuracy of bank statement processing.

![[Translate to Englisch:] [Translate to Englisch:]](/fileadmin/_processed_/5/9/csm_effiziente-finanzprozesse-mit-ki-bild_51c4985213.jpg)